The typical cost of car insurance in Dayton, Ohio, is $564 for a six-month policy, which is more than the Ohio state average of $523 but less than the national average of $880.

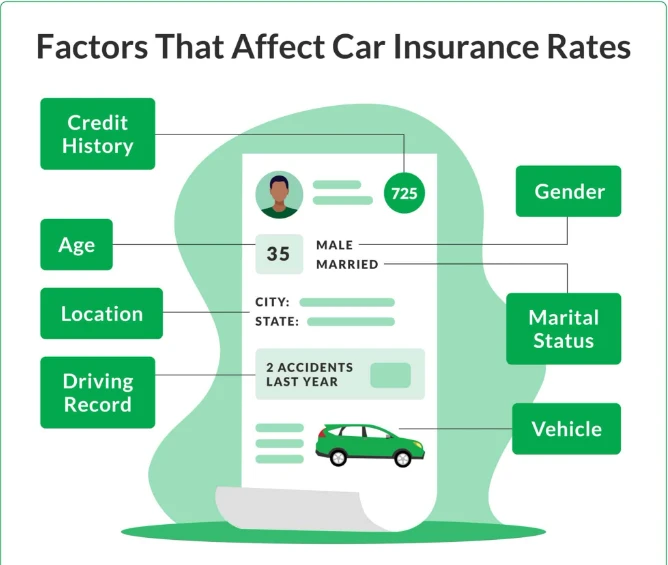

This guide provides insights into how factors like age, credit score, and driving history can impact insurance rates in Dayton.

Dayton vs. Ohio Car Insurance

- The average premium in Dayton is $564 for a six-month policy, while the Ohio state average is $523.

- Dayton’s auto insurance rates are lower than the national average.

Key Takeaways on Car Insurance in Dayton

- The average monthly cost for car insurance in Dayton is $94.

- GEICO is the least expensive insurer in Dayton, offering six-month policies at $339.

- According to The Zebra, 36% of customers in Dayton switched insurance because they were overpaying with their previous provider.

Sources & Data Collection Approach

Our information is a mix of external and internal sources, ensuring it reflects real-world experience within the insurance industry. This section explains how we acquire and manage the data featured across our site.

For further queries or feedback, you can contact us at press@thezebra.com.

Dynamic Insurance Rating Tool for Auto Insurance

Insurance companies must submit rate filings to state regulatory bodies to ensure premiums are fair and non-discriminatory. Thanks to our partnership with Quadrant Information Services, we use these rate filings to provide the most current information.

Our Dynamic Insurance Rating Tool, a unique insurance premium estimator, collects and stores these rate filings. It also enables us to generate pricing for various driving profiles, considering factors like credit score, coverage level, and driving record. One common profile we use includes:

- A 30-year-old single man with a good credit score and no history of accidents or violations.

- A 2015 Honda Accord with 50/100/50 liability limits, plus $500 deductibles for comprehensive and collision coverage.

- This profile is averaged across the U.S. by sampling over 34,000 ZIP codes.

Here’s an example of how this data is displayed on our auto insurance page:

| Company | Avg. 6 Mo. Premium |

|---|---|

| Allstate | $1,206 |

| Farmers | $893 |

| GEICO | $771 |

| Nationwide | $738 |

| Progressive | $941 |

| State Farm | $785 |

| USAA | $683 |

Dynamic Insurance Rating Tool for Home Insurance

Like our auto insurance content, the homeowners’ rates on our site are powered by Quadrant Information Services. As of 2024, these rates are updated annually.

Our homeowners’ content often uses a profile of a married 45-year-old living in a 2,500-square-foot single-story home built in 2011 with a standard HO-3 policy. This profile includes:

- $200,000 for Dwelling Coverage (Coverage A)

- $20,000 for Other Structures Coverage (Coverage B)

- $100,000 for Personal Property Coverage (Coverage C)

- $100,000 for Personal Liability Coverage (Coverage F)

- $1,000 deductible

We adjust this profile as needed to deliver the most accurate and relevant homeowners’ insurance rates to our readers.

Here’s an example of how this data appears on our homeowners’ insurance content:

| Company | Avg. Annual Premium | Avg. Monthly Premium |

|---|---|---|

| Allstate | $1,561 | $130 |

| American Family | $1,764 | $147 |

| Amica Mutual | $2,843 | $237 |

| Farmers | $1,871 | $156 |

| Nationwide | $1,231 | $103 |

| State Farm | $1,484 | $124 |

| Travelers | $2,674 | $223 |

| USAA | $1,385 | $115 |

Anonymized User Surveys

Since 2012, we have helped more than 18 million people shop and compare insurance quotes for homes and autos. We’ve gained valuable insights from this experience.

Our site features anonymized customer data collected during the quoting process, helping us offer guidance based on real-world user experiences.

This approach ensures our advice is relevant and beneficial to our users.

Here’s an example of how we use this information on our car insurance quotes landing page.

Anonymized User Data on Our Car Insurance Quotes Landing Page

We ensure that our anonymized survey process complies with privacy laws and best practices:

- Data Anonymization & Aggregation:

Personal Identifiable Information (PII) like names, exact addresses, and email addresses are excluded from our surveys. Data is aggregated to prevent the identification of individual users.

- Analysis & Recommendations:

Our insurance analysts review the anonymized data for insights and trends, guiding our advice. Recommendations are validated by our team of licensed insurance writers for accuracy and clarity.

Finding the Best Insurance Rates

The best way to find the most affordable insurance is to compare quotes. We suggest using our comparison tool, which includes rates from Progressive, State Farm, GEICO, and USAA, among others.

Enter your ZIP code for a personalized quote without any junk mail or spam calls.

Car Insurance Rates by Age

- The insurance rates vary by age group. Drivers in their 50s pay about $501 for a six-month policy, while those in their 60s pay slightly more at $515.

- Teenage drivers face the highest rates, with an average premium of $2,611 for six months. However, turning 20 can lead to a significant reduction in rates.

Insurance Costs by Credit Score

Credit scores affect insurance rates. Drivers with higher credit scores tend to pay less.

For example, drivers with an “Exceptional” credit score (800-850) pay an average of $452 for a six-month policy, while those with “Very Poor” credit (300-579) pay $1,082.

Impact of Violations on Insurance Rates

A clean driving record keeps your insurance rates low, while violations like DUIs, reckless driving, and speeding can lead to steep increases.

In Dayton, a reckless driving citation could increase your insurance rates by $680 per year, while a DUI might lead to a $686 increase.

By comparing quotes and maintaining a clean record, you can find the best rates for car insurance in Dayton.

Aolso read: Cheap Car Insurance In Abilene

The average six-month premiums for auto insurance in Dayton after various violations: